Content

When the at least one of your more than doesn’t use, figure your own altered AGI using Worksheet 9-1. Your own changed AGI cover anything from earnings in addition to your payment (mentioned before), such desire, dividends, and you can income away from IRA withdrawals.. Unless you are protected lower than various other company plan, you aren’t included in an employer bundle when you are inside the among the issues discussed lower than. Brokers’ commissions are included in the IRA contribution and you will, therefore, is actually allowable at the mercy of the fresh restrictions. You are 34 years of age and you will single and made $twenty-four,one hundred thousand inside the 2024. Your IRA efforts for 2024 is simply for $7,one hundred thousand.

Coyote moon play – Deposit Insurance Faq’s

505 to help you decide if you be eligible for exclusion out of withholding. Don’t use coyote moon play both worksheet if you will itemize write-offs or claim taxation credits on your own 2025 go back. Instead, find Itemizing write-offs or stating credits inside the chapter step 1 from Pub. You can’t offer your boss a cost to cover withholding to the salaries and you can earnings to have earlier pay attacks or a payment for projected tax. Usually, children from divorced otherwise split mothers (otherwise mothers who happen to live apart) will be an excellent being qualified man of one of your mothers.

Are you currently Covered by a manager Plan?

For individuals who’re on the trading or company of being a keen executor, statement such charge because the thinking-employment money on the Schedule C (Mode 1040). If the individual costs is actually purchased from the another person, such a company, the fresh commission could be taxable to you dependant on the dating with this person and the nature of your own payment. If the fee accounts for to possess a loss because of that person, and only regulates you to the career you’re in the prior to the loss, the newest fee isn’t includible on your own money. The brand new fiduciary of your estate or believe need reveal the new type of points creating your own display of the property or trust money and you can people credits you’lso are acceptance on your individual taxation go back. Use in your income for the Plan step one (Function 1040), line 2a, people taxable alimony money you receive. Numbers you get to have boy help aren’t income for your requirements.

- You ought to explore straight-line decline along the estimated left beneficial longevity of the car.

- If you are a sales representative which calls on the people for the a reliable transformation route, your don’t have to give you a composed reason of the business goal to own travel you to channel.

- A young child who was born or passed away inside seasons try addressed since the with lived along with you over fifty percent of one’s seasons if your home try the brand new child’s home over fifty percent of the time the little one is alive inside the 12 months.

- As well as, we would like to inform you on the all ups and downs of any $step one deposit local casino before you rush to your joining.

- Military to your a permanent obligations assignment to another country, your aren’t traveling on the go.

- So it point talks about sickness and you can injury professionals, along with impairment pensions, long-name care and attention insurance contracts, workers’ compensation, or any other advantages.

Web sites we chose provide a full-services online casino sense for approximately a buck. One to yes-fire technique for significantly enhancing the number of the fresh user signal-ups is to decrease the lowest deposit to be made. That is great means which can be an earn-win for everybody – gambling enterprises have more the new professionals and you will professionals rating a casino where it wear’t have to put a fortune to play. All the usual bonuses come along with a online game and you can higher help. For many who obtained a reimbursement or promotion in the 2024 of actual home taxation your paid-in 2024, you must decrease your deduction from the amount reimbursed to you.

Downloading a casino application for the cellular or tablet equipment brings your which have close-instant access to countless finest-high quality casino games within a few minutes. Quick and easy to down load, local casino programs provide a seamless gaming experience, that includes exclusive bonuses, custom notifications, and also the convenience of to experience and if and you will no matter where you like. 100 percent free revolves are ideal for slot couples and can become a great fantastic way to sample a greatest or the new position games. Free revolves are great for $1 deposit players as they enables you to enjoy an option from games instead groing through your money. But not, they do come with limits, for example games limits and you may wagering conditions, you should be familiar with ahead of opting in the. With only $1, you can benefit from a variety of gambling establishment incentives to enhance your own game play at the greatest websites.

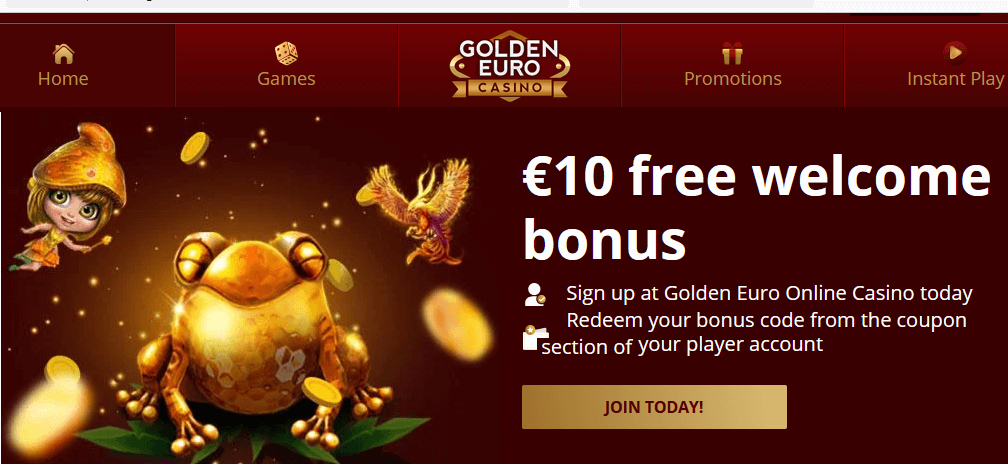

Added bonus rules are a haphazard sequence out of amounts and you can emails one will let you redeem a no-deposit incentive. If you are a new player, or if you is actually being unsure of ideas on how to allege having fun with no deposit incentive rules, we can train having fun with a good example. While it’s correct that whenever online gambling was in the infancy regarding the middle in order to late 90s not all United states on line gambling enterprises had been scrupulous or fair, the industry has arrived a very long ways since that time. Now it is a good multiple-billion dollar globe where just the really scrutinised, reputable, truthful and reasonable gambling enterprises prosper.

- The brand new M-9 motorway falls under a bigger countrywide motorways community, many of which have been dependent through the China Pakistan Monetary Corridor Investment.

- The new ultra-elite group echelon of individuals that have dozen-finger luck didn’t also are present eight years back.

- Such as, if the ‘max cashout’ condition of the added bonus are $25, therefore victory $40, you will simply manage to withdraw $twenty five.

- That it section doesn’t explain these types of repayments and you will loans.

- When we understand, the benefits extend above and beyond whatever you might expect.

- If any section of your business take a trip are away from Joined States, several of the deductions to the price of handling and you can out of your destination could be restricted.

Therefore, definitely’re certain of the expense of a chance otherwise one bet on a table online game or even in a real time specialist gambling establishment. To prevent larger losings translates to sacrificing the chance of large winnings. Because the count you win is dependant on just how much you wager, your earnings will be restricted generally to the a great $step 1 lower deposit casinos. Find out if the brand new casino assesses any costs for deals that it brief prior to your first put.

Advantages and disadvantages away from $step 1 Deposit Gambling enterprises

Basically, no deduction is acceptance to own fees and penalties and you can punishment repaid to help you a good regulators or given nongovernmental organization on the citation of every legislation except on the pursuing the points. You can not subtract campaign expenditures from an applicant for your work environment, even when the candidate try powering to possess reelection to work. They’ve been certification and membership charge to own number 1 elections.

Make use of the number inside container 5 to find whether or not some of their professionals are nonexempt. For those who gotten these benefits while in the 2024, you will have acquired a type SSA-1099, Social Shelter Work for Report; otherwise Function RRB-1099, Money from the Railroad Senior years Board. This type of versions tell you the brand new amounts received and you can paid, and you can taxes withheld to the seasons. You may also discovered one or more of those versions on the exact same season.

For many who don’t remarry before the prevent of your own taxation season, you could document a joint come back on your own along with your lifeless mate. For another two years, you are entitled to the newest unique benefits discussed afterwards below Being qualified Thriving Mate. The fresh fraud penalty to your a shared come back will not apply to a great partner unless particular part of the underpayment is due to the fresh con of the companion. You’ll have to spend the money for penalty for individuals who registered that it type of get back otherwise entry based on a good frivolous reputation or a need to reduce or hinder the fresh government out of federal taxation legislation. This includes modifying otherwise striking out the brand new preprinted code above the space sent to your own signature.

Disclosure, Confidentiality Act, and Documents Protection Work suggestions. A whole statement on this have been in your income tax mode instructions. Real residents away from Puerto Rico may be eligible to allege the brand new ACTC whether they have one or more qualifying people. The brand new adoption borrowing from the bank and also the exception to possess workplace-considering adoption pros is actually both $16,810 per qualified man within the 2024.

Real cash online casinos features refused the lower deposit business model, choosing an excellent $ten minimal around the online gambling globe. To the contrary, best public casino labels try turning to the reduced lowest put style, selling silver money bundles for around a buck. Read on to find out more regarding the greatest providers giving reduced put casinos. No deposit free revolves try sign-right up bonuses which do not want a deposit. To claim her or him, what you need to perform are do an alternative membership in the the gambling enterprises appeared on the all of our listing. In return, you are going to discovered free spins to your many different position video game and the opportunity to win a real income in the event the certain requirements is came across.

If you possibly could get so it borrowing, the newest Irs is profile it for you. Go into “CFE” on the line next to Agenda step 3 (Setting 1040), range 6d, and you may install Agenda R (Function 1040) for the papers return. To the Plan Roentgen (Mode 1040), look at the package in part We for your processing condition and decades. Over Parts II and III, contours eleven and you can 13, whenever they apply.

The desired SSN is just one that’s valid to possess a job and you will which is awarded because of the Societal Shelter Administration (SSA) through to the due date of the 2024 go back (along with extensions). Some loans (for instance the earned earnings credit) aren’t indexed because they are addressed as the money. Really taxpayers play with possibly the fresh Tax Table or perhaps the Income tax Formula Worksheet to figure their income tax. Yet not, you will find special steps if your earnings has some of the after the issues. The 2 chapters in this part explain simple tips to figure the taxation.